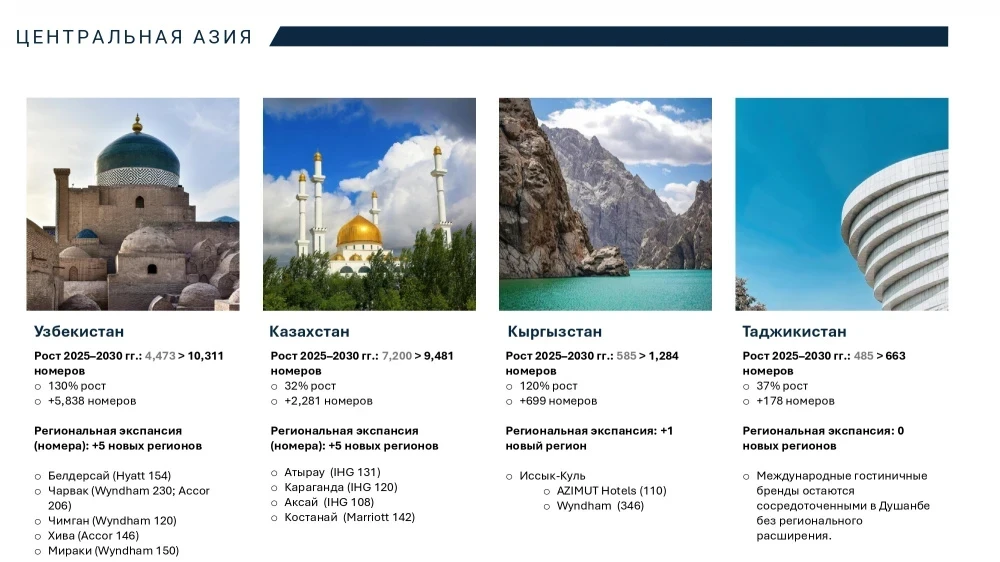

According to forecasts, the number of hotel rooms will increase over the next five years. However, each country will develop at its own pace, and it is expected that Kyrgyzstan will become the leader in growth rates.

Global brands boost tourist and business influx

Central Asia is actively positioning itself as one of the new centers of tourism, combining the heritage of the Silk Road, UNESCO World Heritage sites, picturesque mountain landscapes, and unique cultural experiences. The region attracts both cultural tourism enthusiasts and those interested in eco, medical, or gastronomic tourism. Last year, more than 15 million tourists visited the Central Asian countries.Among hotel chains, Accor and Hilton stand out, opening new properties annually (with the exception of 2024 and 2025). A temporary slowdown in the opening of new hotels is expected in 2024, but activity will resume in 2025.

Each country has its unique features in the development of the hotel business. Kazakhstan remains a key player in this industry, while the peak of new brand openings occurred in 2020, after which there has been a decline in the number of new properties.

In Uzbekistan, the Hilton chain shows stable growth, opening new hotels annually from 2020 to 2024. Overall, the hotel sector of the country has increased fourfold due to the arrival of international brands.

According to Commonwealth Partnership Uzbekistan, the hotel market in Tajikistan remains limited, but there are signs of renewed activity, including plans to open new hotels. Hyatt holds a leading position in this market, controlling 46% of all rooms, while Hilton and IHG account for 30% and 24%, respectively.

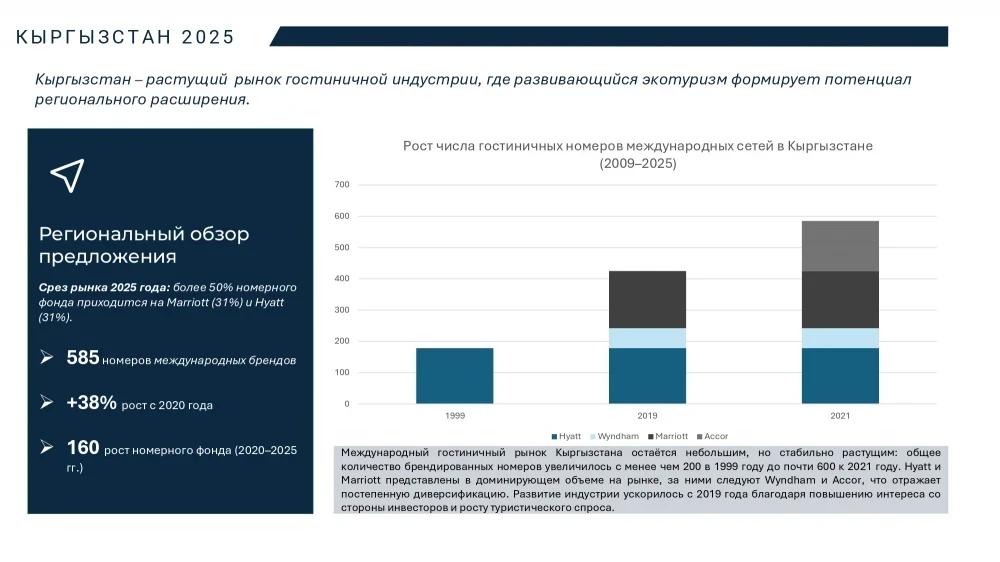

Stable development of the Kyrgyzstan market

Although the international hotel market in Kyrgyzstan is not very large, it shows steady growth. The majority of global hotel chains are represented in Bishkek, including Hyatt, Wyndham, Accor, and Marriott. The demand for hotels is primarily driven by business, diplomatic, and eco-tourism.Hyatt was the first international player in the market, and Accor's entry in 2021 completed the formation of the country's international hotel portfolio. Currently, Marriott and Hyatt each hold 31% of the market, Accor has 27%, and Wyndham has 11%. The sector's development accelerated from 2019 due to growing interest from investors and an increase in tourist flow.

A feature of Kyrgyzstan is its commitment to diversifying the hotel market through projects in the premium and niche segments.

The future of growth

Analysis shows that the presence of international hotel brands in Central Asia will grow over the next five years. Uzbekistan and Kazakhstan will act as the main drivers of this growth. While Kazakhstan previously led in the number of hotel rooms, this year Uzbekistan may take that place. Kyrgyzstan and Tajikistan continue to develop gradually.Kyrgyzstan is ahead in brand diversification and the number of new openings in the market.The project portfolio of Kyrgyzstan is focused on 2026-2027, where Wyndham accounts for 69% of the rooms, followed by AZIMUT (16%) and Hilton (15%). It is expected that from 2025 to 2030, the number of hotel rooms in the Central Asian region will double, with Accor leading the market at 19%, followed by Hilton (18%) and IHG (17%).