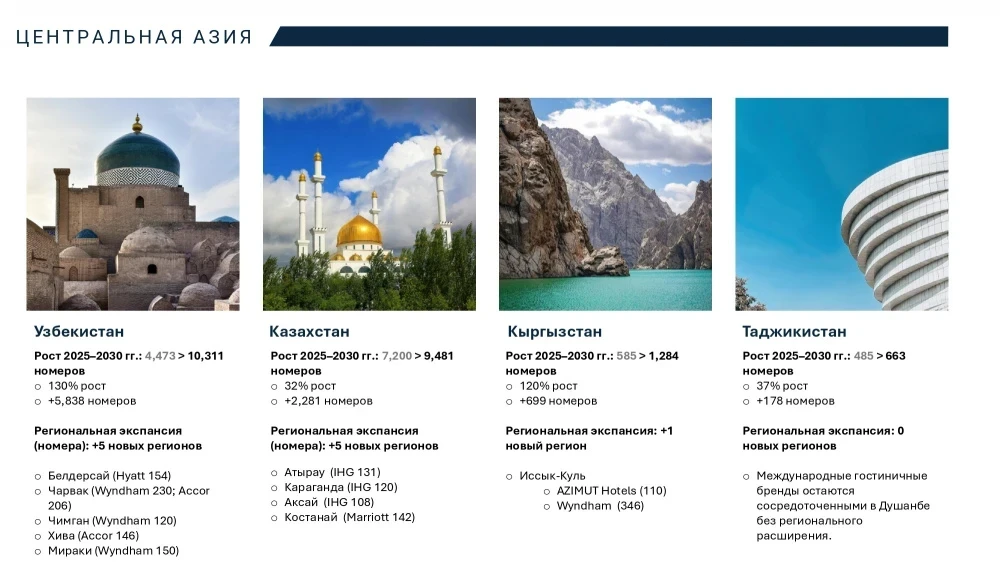

According to forecasts, the number of hotel rooms will increase over the next five years. Each country in the region will develop along its own path, and experts believe that Kyrgyzstan will demonstrate the highest growth rates.

Growth of tourist and business flows with the participation of global brands

Central Asia is rapidly transforming into one of the new tourist centers, combining the heritage of the Silk Road, UNESCO sites, picturesque mountain landscapes, and unique cultural experiences. The region attracts both cultural route enthusiasts and those who prefer medical, ecological, or gastronomic tourism. Last year, more than 15 million tourists visited the countries of Central Asia.Among hotel chains, Accor and Hilton are the most active, opening new properties almost every year (Accor - except for 2024; Hilton - in 2025). However, a temporary slowdown is expected in 2024 after a sharp increase in new hotel openings, with activity recovering in 2025.

Each country has its unique features in the development of the hotel business. Kazakhstan remains a key center of the hospitality industry in Central Asia, where the peak of new brand openings occurred in 2020, after which the pace slowed down.

In Uzbekistan, the Hilton chain demonstrates stable growth, opening hotels every year from 2020 to 2024. As a result, the country's hotel sector has quadrupled since 2020 due to the arrival of international brands.

In Tajikistan, the hotel market remains limited but is already showing the first signs of recovery: new openings are planned. In the market of branded hotels in Tajikistan, Hyatt leads with a share of 46%, followed by Hilton (30%) and IHG (24%).

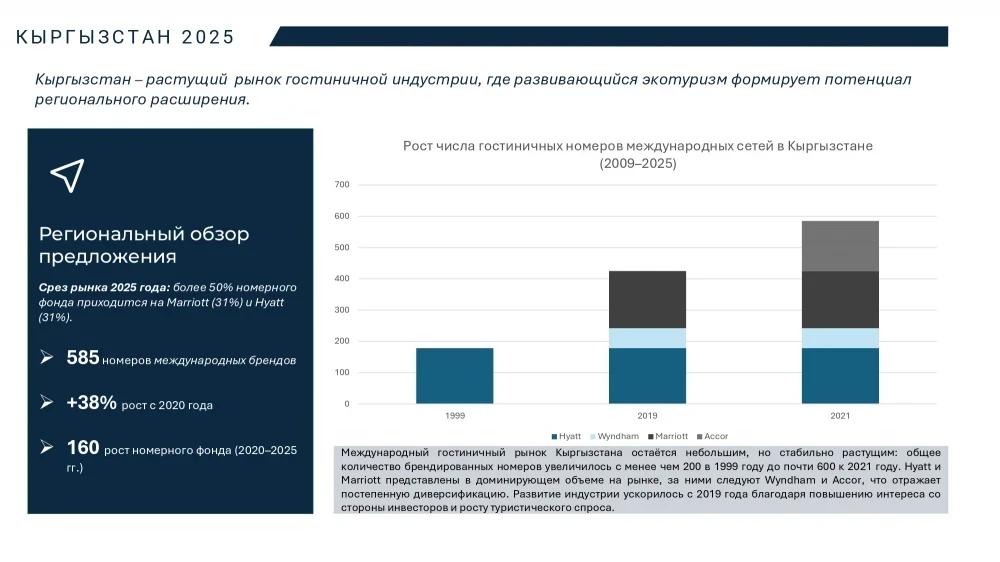

Stable growth of the hotel market in Kyrgyzstan

Although the international hotel market in Kyrgyzstan is still small, its development is stable. In Bishkek, chain hotels such as Hyatt, Wyndham, Accor, and Marriott are concentrated, with demand driven by business, diplomatic, and eco-tourism.Hyatt is a pioneer in the market, and Accor's entry in 2021 was the latest addition to Kyrgyzstan's international hotel portfolio. Currently, Marriott and Hyatt each control 31% of the market, Accor holds 27%, and Wyndham has 11%. Since 2019, the hospitality industry has accelerated due to growing interest from investors and an increase in tourist flows.

A distinctive feature of Kyrgyzstan is that the republic diversifies its hotel market through projects in the premium and niche segments.

Market growth prospects

Analysis shows that the number of international hotel brands in Central Asia will grow over the next five years. The main drivers of this process will be Uzbekistan and Kazakhstan. While Kazakhstan previously led in the number of hotel rooms, Uzbekistan may take this position this year. Kyrgyzstan and Tajikistan continue to develop more gradually.Kyrgyzstan is ahead in brand diversity and the number of new market entries.The project portfolio of Kyrgyzstan is focused on 2026-2027, led by Wyndham, and the entry of Hilton and AZIMUT brands heralds a new wave of diversification. Wyndham occupies 69% of the room stock in the country's project portfolio, followed by AZIMUT (16%) and Hilton (15%).

From 2025 to 2030, a nearly twofold increase in the number of international hotel rooms in the region is expected. The leading players in the market will be Accor (19%), Hilton (18%), and IHG (17%).