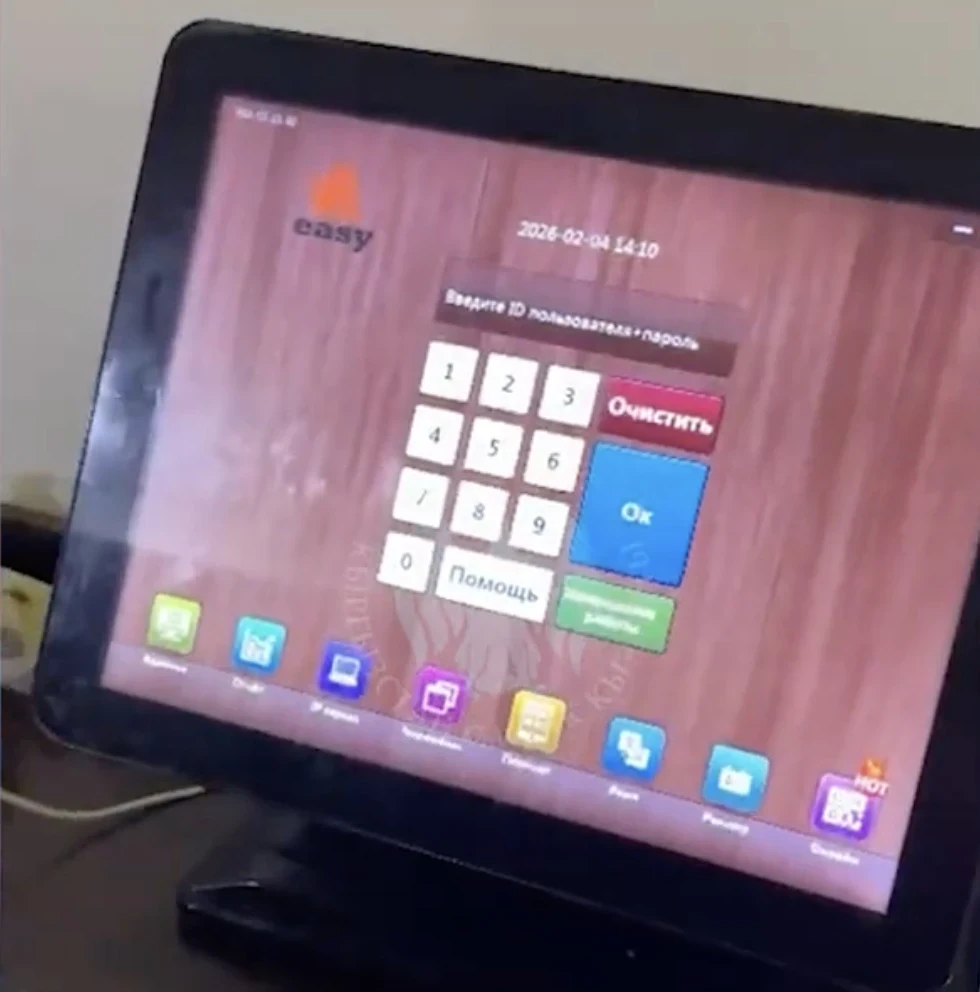

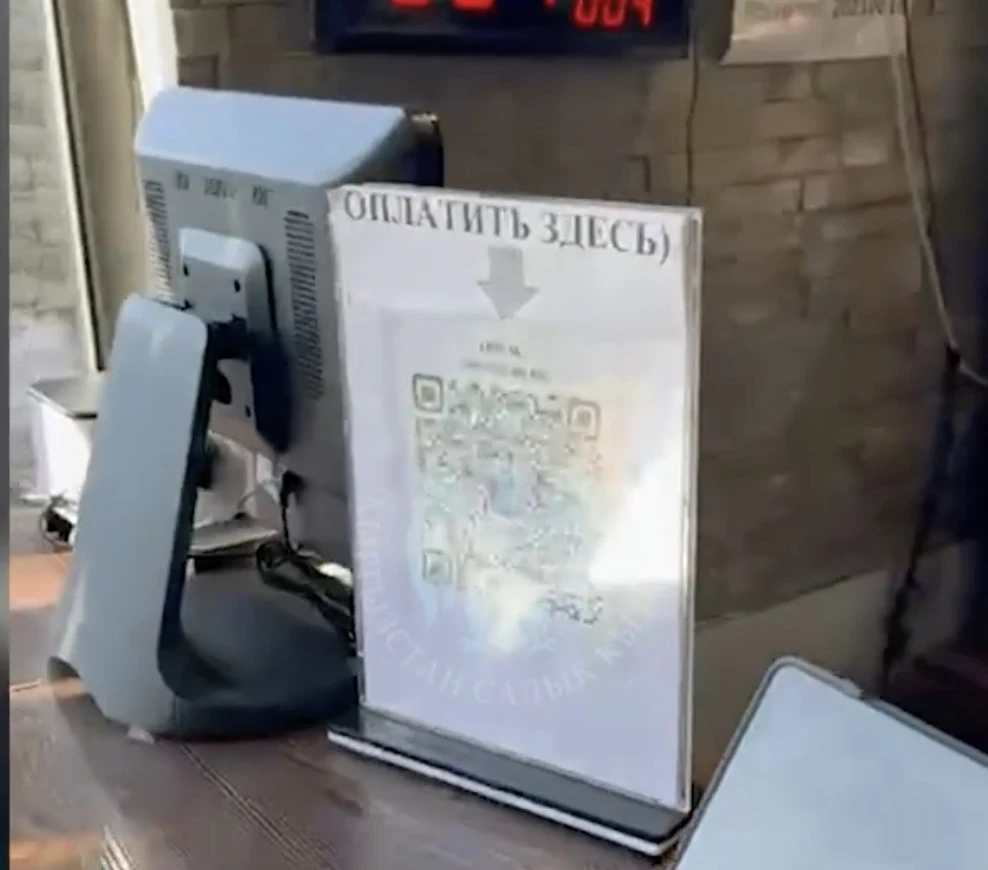

During inspections, tax inspectors discovered serious violations in the "Kuldja HOGO" cafe chain. In three establishments owned by the same owner, unregistered programs were used for conducting so-called shadow accounting, meaning that part of the sales was not recorded in the official fiscal system. It was also found that payments were made through QR codes registered to private individuals rather than to the company itself. Cash was also found at the registers that lacked confirmation in the form of fiscal receipts.

Photo from the video of the press service of the State Tax Service of the Kyrgyz Republic.

Photo from the video of the press service of the State Tax Service of the Kyrgyz Republic.

Photo from the video of the press service of the State Tax Service of the Kyrgyz Republic.

The tax service plans to continue such inspections. The agency emphasizes that maintaining double accounting and concealing income is against the law, and such actions carry liability – up to criminal punishment if signs of a crime are identified.