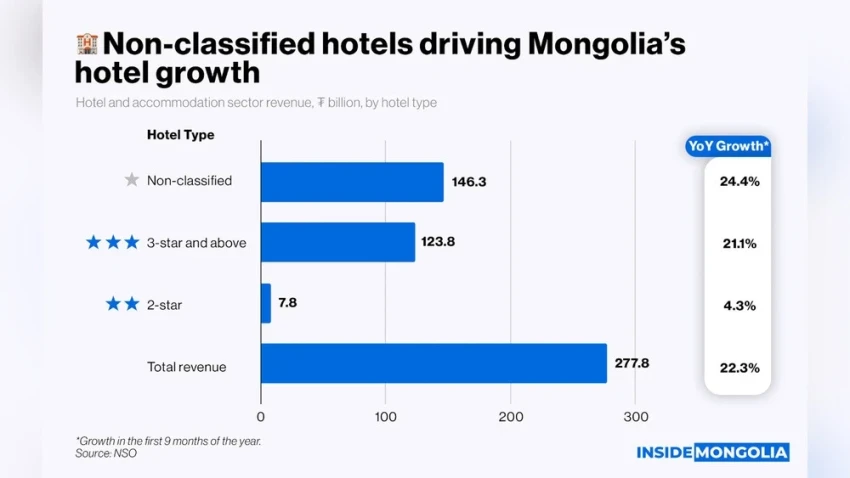

“According to the latest data: from the National Statistical Committee, the income of the hotel and tourism sector in Mongolia increased by 22.3% in the first three quarters of 2025 compared to the same period in 2024, amounting to ₮277.8 billion,” reports InsideMongolia.

? There has been record growth over three years

From 2022 to 2024, the total income of the sector increased from ₮208.3 billion to ₮320.9 billion, representing a 54% growth over three years. Additionally, the average annual growth rate during this period was about 24%, indicating sustainable development rather than a temporary recovery after the pandemic.

?️ Unclassified hotels contribute to growth

The growth of the sector is mainly attributed to hotels that do not fall into specific categories. These establishments currently generate the largest share of accommodation revenue. In particular, revenue from unclassified hotel services increased by 58.5%, reaching ₮167.2 billion in 2024 compared to the previous year. Also, in the first 9 months of 2025, they earned ₮146.3 billion, which is almost equal to the total income for 2022. The main factors for this growth were domestic tourism, increased length of stay in cities, and flexible accommodation conditions, rather than the opening of new high-end facilities.

⭐ Slow growth in the premium hotel segment: At the same time, the segment of hotels with 3 stars and above increased from ₮95.3 billion to ₮143.7 billion from 2022 to 2024, reaching ₮123.8 billion at the beginning of 2025. Despite ongoing expansion, this segment still faces limitations in production capacity and high operating costs.

⚠️ Issues with two-star hotels: The annual income of two-star hotels is about ₮10 billion, and they find themselves in a difficult position between the economy class and premium segments, raising concerns about their long-term competitiveness.

?️ Capacity issues

Despite positive results, the hotel industry in Mongolia faces structural limitations in capacity, especially in the off-season months. There are a total of 492 hotels, 486 guest houses, and 922 tourist camps in the country, offering approximately 35,560 sleeping places. However, seasonal demand significantly reduces supply: of the 145 winter camps listed, only 55 are operational, providing just 3,500 beds while high demand is concentrated in urban areas.

Overall… In Ulaanbaatar, there are international 4 and 5-star hotels such as Shangri-La, Kempinski, Best Western, Novotel, and Pullman. However, during peak months from June to September, there is a shortage of rooms, highlighting the imbalance between supply and demand for high-end accommodations.