He clarified that he does not possess such an amount, and the data presented are assets reflected in the reporting.

The deputy noted: "The declaration states 12 billion, but in reality, I do not have such funds. These are just assets. Some have started to claim that such money would be enough to pay off the state debt to China. I did not want to comment on this issue, but since discussions are ongoing, I will say the following. The law on asset legalization stipulates that when legalizing amounts over 100 million soms, it is necessary to pay 1 million soms. But for some reason, they indicated 12 billion. Perhaps they just added extra zeros. Because of this, I had to pay 1 million soms. Yes, we have some, but I do not have such money," he noted.

Tashiev also emphasized that thousands of citizens have legalized their assets. At the same time, he believes that information about his declaration should not have been made public without his consent.

"The president legalized, it seems, $20 million, but he reported it himself. I did not give permission, so the state bodies had no right to do this. Why is my information known, while data on those who legalized large businesses and shopping centers worth billions of dollars is absent? We have two or three houses and one or two cars, and this immediately became public knowledge. According to the law, law enforcement agencies have no right to check these assets without grounds. If they ask me to indicate sources, I will show what I have, and what I do not have, let them search for it. If they do not find it, how can I show it?" he added in the interview.

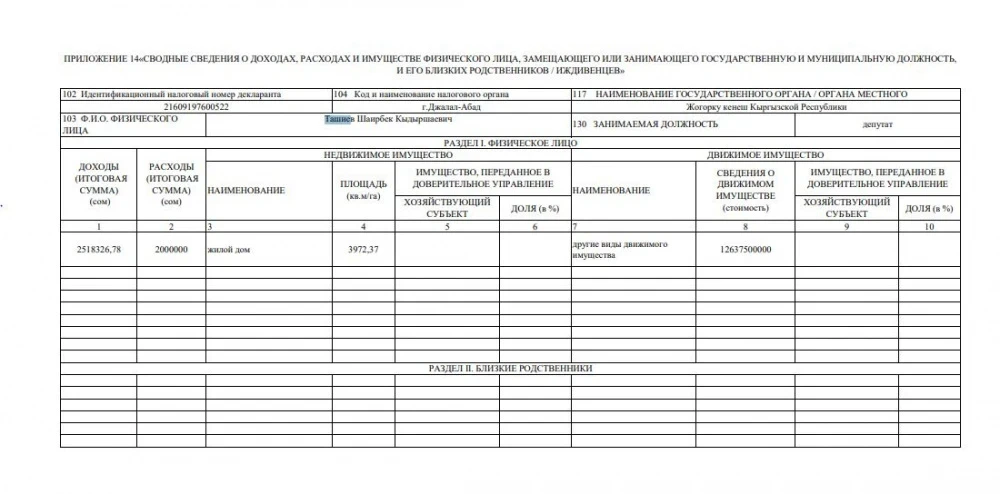

Contents of the Declaration

The document submitted by the State Tax Service contains mandatory fields for the declarant to fill out.In the declaration, it is stated that the income amounted to 2 million 518 thousand 326.78 soms, while the expenses were 2 million soms. Shairbek Tashiev has a residential house with an area of 3,972.37 square meters, or 0.39 hectares (according to the established template, the area is indicated in square meters or hectares).

The most intriguing section concerns another type of movable property, where the amount of 12 billion 637 million 500 thousand soms is mentioned. Usually, declarants list their property, including large and small cattle, horses, furniture, cars, expensive household appliances, jewelry, stocks, and other securities.

Comment from the State Tax Service

The State Tax Service Kaktus.media explained that tax reporting, including the declaration, is prepared by the taxpayer or their representative independently.The unified tax declaration is submitted electronically through the taxpayer's cabinet. To access the cabinet, it is necessary to fill out an electronic registration form with personal data, including a password known only to the applicant. After that, by presenting a passport, the taxpayer confirms their registration in the cabinet.

Thus, access to the taxpayer's cabinet is only available to the declarant themselves or their representative, and no one else can submit a declaration on their behalf.

The information in the declaration is verified:

- for civil servants from July 1 of the current year;

- for individuals during field, desk, and liquidation audits;

- for legal entities during field, desk, and liquidation audits.

Individuals and legal entities also have the opportunity to clarify the declaration within the statute of limitations for tax obligations, except for:

- during the period of a field tax audit, including cases of suspension of such an audit;

- for the tax period for which there is a decision by the tax authorities based on the results of the audit, if that decision has not been canceled;

- in the presence of a court decision on the collection of debts or enforcement proceedings based on enforcement documents from the tax authorities.

The responsibility for the accuracy of the data indicated in the tax reporting, including the declaration, lies with the declarant (taxpayer).