Recent statements by Xi Jinping about the need to create a “strong currency” and its financial foundation are becoming increasingly significant.

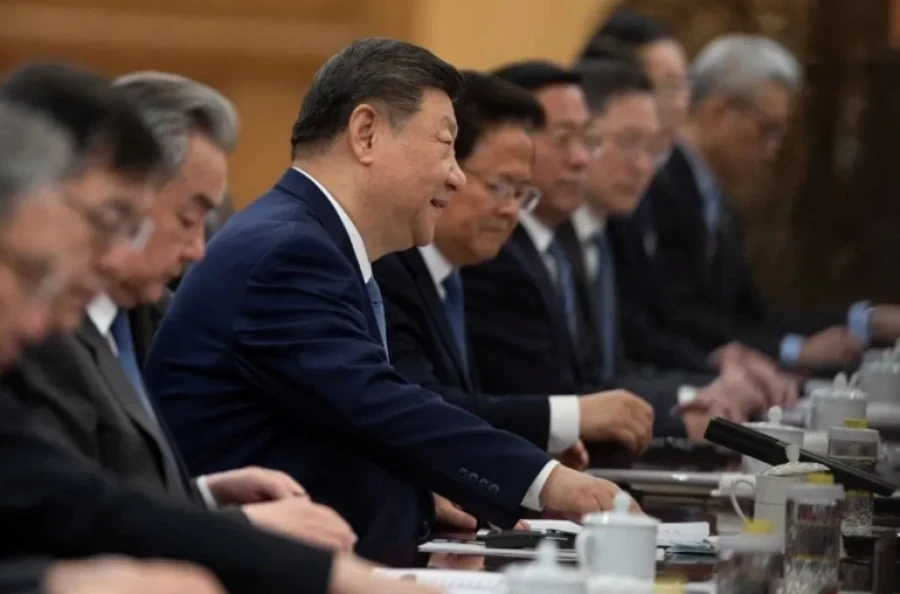

Xi Jinping, the head of the PRC, stated that the yuan should take its place as a global reserve currency, which is a key aspect of building a powerful financial power. The publication “TRT in Russian” examines whether China can reduce its dependence on the US dollar.

The Importance of a “Strong Currency” for China

Xi Jinping emphasized that the yuan must be actively used in international trade, investments, and currency markets. The Chairman of the PRC aims to increase its role in global settlements and reserves.

These ideas were outlined in an article by Xi Jinping, published in the official journal of the Communist Party of China — Qiushi.

According to the Chinese leader, the country needs a “powerful central bank” capable of effectively managing financial flows, as well as competitive financial institutions that can attract international investments and influence global price formation.

The Chinese authorities have long sought to internationalize the yuan, and now Xi Jinping's words about a “strong currency” and the necessary financial foundation are becoming particularly relevant.

Initially, these statements were directed at high-ranking regional officials in 2024, but they were only published at the end of January 2026.

Xi Jinping's article was published against the backdrop of growing uncertainty in global markets. Economist Kevin Lam from Pantheon Macroeconomics noted that China is feeling the reality of changing the world order more than ever before.

It is not surprising that central banks around the world have begun actively acquiring gold, preferring it to the dollar. In 2015, the dollar accounted for about 59% of reserves, while gold accounted for 10%. Currently, the dollar's share has fallen to 41%, while gold's share has risen to 28%.

Experts link this to the weakening of the dollar and Donald Trump's pressure on the US Federal Reserve, which is expected to change leadership in the spring.

Geopolitical tensions and trade wars are also prompting a reassessment of attitudes toward the dollar. Xi Jinping's emphasis on the yuan reflects changes on the international stage.

China's Strategy in the Financial Sector

China, known for its strategic approach, began searching for ways to reduce dependence on the dollar more than 17 years ago.

The 2008-2009 crisis was a turning point when the PRC first allowed international settlements in yuan at a special rate set by the People's Bank of China.

Since then, the yuan has gradually been turning into a global reserve currency, although this process is slow and variable in success.

“The yuan is strengthening its position in international settlements, especially in trade with Asia, the Middle East, and Africa. Bilateral currency agreements and cross-border payment infrastructure are developing,” noted investment advisor and founder of the “Finansology” university, Yulia Kuznetsova.

According to Zhu Heshin, Deputy Chairman of the PBC, in 2024 about 30% of China's foreign trade payments are made in yuan, including settlements with Russia, where both yuan and ruble are used. By the end of 2025, the share of such transactions exceeded 99%.

However, experts believe it is premature to talk about the yuan's real chances of achieving the status of a global reserve currency. According to SWIFT, the yuan ranks only fifth or sixth in terms of transaction volume in the world, with its share fluctuating between 2.5% and 3.5%. It lags behind not only the dollar and euro but also the British pound and Japanese yen. In global gold and currency reserves, the yuan accounts for less than 2.5%.

Reasons for the Yuan's Weakness

These figures are significantly lower than the scale of the Chinese economy, which accounts for about 19-20% of the global total. In global trade, China's share is about 15%.

Moreover, the yuan does not meet the main criteria for a reserve currency, as it is not freely convertible. The People's Bank of China continues to control the yuan, and a special exchange rate different from the domestic one is used for foreign economic settlements. Additionally, the capital market in China remains closed.

“The status of a reserve currency has its downside: a high structural demand leads to an appreciation of the exchange rate. This can be beneficial for countries that dominate in imports, but China is export-oriented, and a strong currency does not always align with growth objectives,” explains Yang Pinchuk, Deputy Head of the Exchange Trading Department at WhiteBird.

The Future Without Chances

Despite all efforts, the yuan cannot yet claim the role of a global reserve currency. However, China continues to reduce its dependence on the dollar in international trade, expanding settlements in yuan, accumulating gold, and diversifying currency reserves.

Nevertheless, in the near future, China is unlikely to be able to completely abandon the dollar, which continues to be a key currency in global trade and commodity markets, as Yulia Kuznetsova asserts.

She adds that currently no other currency has a chance of replacing it. For example, the euro, while ranking second, faces problems caused by the fragmentation of financial policy within the European Union.

Today's statements by Chinese authorities are part of a long-term strategy aimed at strengthening financial sovereignty. Thus, sharp changes should not be expected in the near future.

Experts suggest that the future does not belong to a “new dollar,” but to a multipolar currency system, where the dollar will maintain its dominant position, but its share will gradually decrease due to regional currencies, gold, and alternative settlement mechanisms.

Photo www